novanta, inc. (novt) ceo matthijs glastra on q2 2018 results - earnings call transcript

by:QUESTT

2020-08-08

Novanta, Inc. (NASDAQ:NOVT)

August 8, 2018 morning 10: 00 2018 quarter earnings call

Company finance supervisor

Robert Buckley, CEO and director

Cfoanalystlee Jagoda-

Richard Eastman-Robert W. Baird & Co. Brian Drab -

Good morning, William Blair.

My name is Andrew. I will be your conference operator today.

I would like to welcome you all to Novanta Inc at this time.

2018 Second quarter earnings call. [

Operation instructions].

Please note that this activity is being recorded.

I want to hand over the meeting to Sir now.

Ray Nash, head of corporate finance

Please continue.

Ray NashThank you a lot.

Good morning, welcome to the 2018 earnings call for the second quarter of Novanta.

I\'m Ray Nash, head of corporate finance at Novanta.

Today\'s call is Matthijs Glastra, our chief executive;

And our chief financial officer, Robert Barkley.

If you do not receive a copy of our earnings press release released today, you can get it from the Investor Relations section of our website. novanta. com.

Please note that this call is live webcast and will be archived on our website shortly after the call.

Before we start, we need to remind everyone of the safe harbor ahead --

The earnings press release we released earlier today and the statement outlined in the SEC document.

We may make some comments today in our prepared statements and answers to questions, which may include forwarding --

Look at the report.

These include inherent assumptions of known and unknown risks and other factors that may lead to significant differences in our future results from our current expectations. Any forward-

The forward-looking statements made today represent only our views.

We do not assume any obligation to update forward.

Even if our estimates change, you should not rely on these forward-looking statements

At any time after this call, look for statements to represent our point of view.

In this call, we will mention some non-

GAAP Financial indicators.

For this non-

The GAAP financial measures that are most directly comparable to the GAAP measures can be used as an attachment to our revenue press release.

What we use

During this call, GAAP financial measures are inconsistent with the GAAP measures in the earnings press release, and we will provide timely reconciliation in the Investor Relations section of our website after the call.

I am now pleased to introduce Matthijs Glastra, Novanta\'s chief executive.

Thank you, Ray.

Good Morning, everyone. thank you for joining us.

Novanta continued to maintain its momentum, surpassing us in terms of revenue and profit guidance, achieving another strong quarter.

Our company delivered $150.

4 million of revenue, 26%-over-

Annual report revenue growth 6. 2% year-over-

Organic income growth.

This is our seventh consecutive quarter. or high single-digit double --

Organic growth.

Our Adjusted EBITDA is $30.

4 million, an increase of 18% over last year.

Our adjusted earnings per share are $0.

51, up 24% from $0.

The second quarter of 2017 was 41.

In addition, we provide steady cash flow, operating cash flow increased by 19% year on year. over-

The second quarter of this year reached $20 million.

At Novanta, our mission is to provide important innovation and mission-

While improving end-user productivity and improving people\'s lives, provide key features to our OEM customers.

We believe that the strength of our team, our strong business model and diversified applications, as well as balanced contact in the medical and advanced industrial markets, provide us with good service.

We see a trend of convergence and need to implement our motor, visual and optical capabilities in a variety of applications supported by the macro trend of industry 4.

0. productivity of precision medical care and health care.

As a result, we continue to be excited about our location and applications, such as DNA sequencing, robotic surgery, metrology, advanced material processing and precision automation, as well as robotic technology, with long-term support

Long-term market growth trend.

We continue to see this quarter

Based on the growth momentum of the company and all regions, all 3 operations showed double growthdigit year-over-

Annual report revenue growth.

We also continue to maintain stable order performance for the overall book. to-bill of 1.

04 after strong booking performance in the first quarter.

What we see is

Based on market growth in life sciences, minimally invasive surgery, and advanced industries, our growth in any given quarter is more driven by customer technology releases or stages --

Market dynamics are greater than structural in phase-out.

We continue to make strong progress on strategic growth priorities and promote long-term

Achieve organic growth through business excellence and innovation.

Annual revenue for new products-to-

The year has doubled. over-year.

Our vitality index is revenue from new products launched in the past 4 years and now exceeds 20% of sales. Our year-to-

Date design wins grew by more than 25%, and our revenue from China grew by more than 30% in the second quarter compared to last year.

We believe these indicators support us.

Long-term organic growth guidance of an average of 5% to 7%.

In terms of productivity, I am proud of the execution of the team and have made a solid contribution to our operational savings.

We are starting to see some of the preliminary effects of the recent tariff changes, but we expect to either reduce the cost or pass the cost on to the customer, so, we do not believe that this impact will have a significant impact on our bottom line.

We\'ll hear more details from Robert about the quarterly and annual outlook, but strong second-quarter results give us confidence in the outlook for the full year of 2018.

In terms of M & A, we reported a good Tucker-

In the acquisition, Zettlex announced an early end at a previous earnings call.

The integration of Zettlex went well and our customers and sales team responded positively as we are deploying Zettlex\'s induction encoder technology through our precision motion sales channels.

The inductive encoder technology is ideal for industrial robots and medical applications, so we think it has greatly expanded our addressable market.

We expect the acquisition of Zettlex to be

The long-term growth trajectory of our Celera Motion business.

Our balance sheet is strong, with sufficient firepower and healthy acquisition channels.

In terms of acquisitions, we maintain discipline, focus on cash and cash returns and accelerate the long term

Long-term growth in target markets.

Now let me talk about our operations.

Our precision sports sector continues to be our strong growth engine at 20% years. over-

A year of revenue growth and stable ordersto-bill of 1.

Quarter 08.

Before that, we discussed that our precise and dynamic motion control functions play a good role in multiple markets with structural growth dynamics, such as precision automation, robotics, metrology, automation

We see a broader trend of mobile robots everywhere, online, factory ground, in the air and underwater, with embedded precision measurement and detection capabilities that enable big data and full digitalization.

In addition to being able to move precisely above

The final performance range of these robots, these applications typically include complex pointing and tracking devices such as frameworks that require precise motion solutions.

These solutions require small size, light weight, energy saving

Able to operate efficiently in demanding environments.

Thanks to our ability to design and deliver the best combination of high precision, performance, power and compact form factor, we are in the best position and win here, enables our customers to create pointing and tracking features in a variety of application and operating conditions.

In the precision motion section, year-to-

Our new product revenue has grown by more than 50% so far, and our Chinese revenue has grown by more than 40% compared to last year as we are bringing new innovations to market and are expanding our business

As we reported earlier, we invested. -

Invest in business, innovation and operational capabilities to drive sustainable growth in this attractive business.

The team is steadily addressing the supply chain issues we previously reported, and while delivery performance has improved significantly, our gross profit margin has not improved as quickly as we originally expected, because we are solving some of the remaining manufacturing inefficiencies for the rest of the year.

The team knows what to do, and now is the time to complete the task.

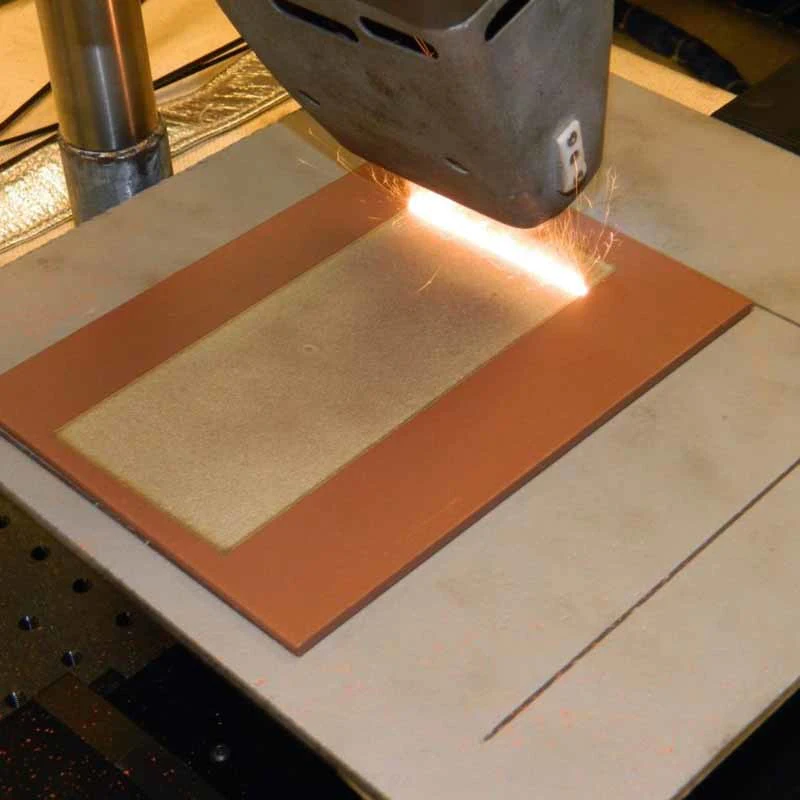

Turning to our photon sector, which achieved revenue growth in the 11% quarter --over-year.

Growth is driven primarily by our beam delivery business as a result of strong commercial execution in an ever-improving industrial environment. Our book-to-

Annual performance-to-date was 1. 02.

So far, revenue from new products has increased by more than 40% over last year.

Powerful applications are made of laser additives, through

Drilling, Micromachining and October.

We are very pleased to see the continued growth and operational execution of our Cambridge technology business, which once again provides record bookings and revenues with a broad momentum across multiple applications.

The team has done a lot of work on-demand execution and business diversity, while improving the core of the overall product in demanding applications.

The breadth of Cambridge apps and customers provides us with a more sustainable and predictable revenue stream.

Due to our proprietary beam steering technology packaged with customers or applications, we won the Cambridge technology business

Specific solutions that enable our customers to win at the fastest, most accurate and highest speed

Efficient solution.

The core technology of Cambridge is the horizontal technology business, which spans many advanced industrial medical markets.

It has nothing to do with which laser power supply or wavelength to use, which makes it a great business

Diversified growth potential.

In the second quarter, Cambridge technology launched

Generation ProSeries Plus 3-

Axis scanning head series of laser exhibition.

These products are mainly used for demanding large-scale on-site micro-processing, laser additive manufacturing and conversion applications.

The ProSeries Plus series provides reliable solutions for long processing runs and extends adjustment options to meet application needsspecific needs. These next-

Generation models provide better accuracy and flexibility for our OEM customersin-

Stable class with high comprehensive abilitypower lasers.

Laser Quantum has a solid quarter and is a powerful contributor to the results of photons.

As we reported on previous calls, following the huge growth of last year\'s new generation of DNA sequencing machines, the growth of this business has begun to normalize to the average growth rate of Novanta.

We are still very positive about the medium term. and long-

Long-term prospects for this business-

Because we believe that the space for DNA sequencing is attractive, our leadership is strong.

Finally, we are satisfied with the productivity, operations and hybrid execution in the photon field, as evidenced by Gross profit margin performance.

Turn to our visual field, including two businesses of minimally invasive surgery technology or MIS;

And detection analysis.

The MIS group includes endoscopy and WOM, focusing on applications for endoscopic and robotic surgery.

The testing and analysis team includes our JADAK business, focusing on reducing medical errors, improving workflow and patient outcomes in applications such as minimally invasive surgery, patient monitoring, life sciences and clinical laboratory equipment.

In the second quarter, our vision Department achieved 58%. over-

Annual revenue growth driven primarily by the acquisition of WOM.

New product revenue in the second quarter more than doubled from last year. The book-to-

Bill in our visual section is 1.

Good booking in MIS.

Our WOM business continues to be hugely attractive in terms of infiltrating new customers, driving new product launch initiatives, and strategically focusing our business on the core competencies of minimally invasive surgical applications.

During the quarter, the business announced its intention to withdraw from its non-core and non-medical product line to reduce the asset strength of the business while increasing its strategic focus on pure medical applications.

The plan will enable businesses to make better use of their growth opportunities.

Despite the fact that changes in European regulation in 2018 led to more difficult times in the second half of 2017, WOM continued to perform as we expected and is expected to achieve the average growth rate of Novanta in 2019.

The recently launched insufflator and pump products from WOM have shown good momentum among manufacturers of endoscopic OEMs.

In addition, we have seen a very strong expansion in their consumer goods business, which, as we explained earlier, has a gross margin of less than the capital equipment business.

Our plan to solve this problem is still on track.

We increased our resources in the quarter and started to develop specific plans, including low

Drive improved cost manufacturing capabilities in 2020 and beyond.

While the business will drag on gross margin in the next two years, we are excited about the opportunity to significantly increase gross margin, and we see and expect to see strong organic growth in the coming years, and the non-cyclical nature of the business.

We are also satisfied with the continued development of the NDS product line.

NDS for the sixth consecutive quarter in the first quarterover-

Driven by 4 k displays, wireless products and new products such as our new video image management and collection products for the integrated operating room market, annual core revenue growth.

In addition, the business has significantly improved profitability and is expected to be a net contributor to our revenue and profit growth in 2018.

Finally, in line with our previous earnings call, our testing and analysis business has seen a decline in organic revenue driven by the old legacy product line and regulatory and reimbursement changes in diabetes care.

We are working to overcome these adverse factors and expect the business to resume growth in the second half of the year.

Still, we see great design wins in the detection and analysis business

The revenue of RFID is rapid.

In the second quarter, we launched

Compact programmable 4-

The antenna port, known as IZAR, is a uhf rfid reader.

This product extends our addressable market to those that need high

Perform RFID reader solutions with minimal engineering integration work.

The reading rate of IZAR reader is over 750 labels per second and the reading range is over 9 m, which makes it ideal for medical and industrial asset tracking, inventory control, smart medical cabinets and access control.

This product is a great example of integrating software and middleware-based intelligence into a complete module that can be seamlessly integrated with our OEM customers.

Early customer response was very positive and the launch momentum of this product was advanced, so we were very excited about the potential here.

As mentioned earlier, the demand for RFID in healthcare is increasing as more and more people need to identify, track and connect devices, drugs and patients to achieve optimal workflow and patient safety.

Thanks to our high attention in the medical market, we believe that we are uniquely positioned to take advantage of this opportunity and see this through the growing demand for our business.

At the end of my section, we were very pleased with the organic revenue growth and profitability we achieved in the second quarter.

We are confident in the 2018 outlook as Novanta\'s leadership in key medical and industrial markets, coupled with a rigorous M & A approach, provides a very solid foundation for sustainable profitable growth.

So I\'m going to transfer the call to Robert to provide more details on our financial performance. Robert?

Robert BuckleyThanks, Matthijs, good morning.

We paid $150.

Revenue in the second quarter of 2018 was 4 million, up 26 year on year.

The report is based on 3%.

Our acquisition has increased revenue by $21. 8 million or 18

3%, the exchange rate of foreign exchange has a favorable impact on our income of US $2. 1 million or 1. 8%.

Organic Growth 6. 2% year-over-year.

The gross profit of 2018 GAAP in the second quarter was $65.

2 million or 43% of sales.

By contrast, $53. 5 million or 44.

9% of sales in the second quarter of 2017. On a non-

The adjusted gross profit for the second quarter was $67, 2018.

Sales were 7 million or 45% compared to $55.

The second quarter of 2017 was 2 million, or 46%.

The adjusted gross profit margin increased in turn, but due to the reduction in gross profit margin in our vision department, the gross profit margin was below 2017.

The vision part gross margin is driven by a higher combination of WOM medical consumer goods sales, which is not part of the previous year\'s performance.

As we explained before, the gross profit margin of the medical consumables business is much lower, so the strong growth of the product line will have a negative mixed effect.

However, we are very excited about the opportunity to increase profit margins here.

We understand what actions need to be taken this quarter and have added resources to the business to start working on more specific plans.

In fact, in the second quarter, we announced the first phase of the 2018 restructuring plan.

The whole project will focus on improving the manufacturing efficiency of our vision operations division to raise the gross margin to the Novanta average.

The focus of the first phase is to rationalize our non-core business, in which case the focus is on stopping the processing of non-medical products to non-medical customers in the WOM business unit.

While our annual income has grown from around $3 million to $5 million, we see this decision as a way to increase the strategic focus of the medical businessonly products;

Improve the organization\'s capacity to expand the manufacture of medical products;

Reduce the asset strength of the business;

Finally, let the enterprise on the road to increase the gross profit margin.

The second phase, which we would like to discuss in more detail in the next earnings release, will focus on maximizing the use of our German manufacturing center to create a German-

The headquarters is located in the center of excellence manufacturers.

One of the core principles of acquiring WOM is to increase our influence and competitive power in Germany, which is an important strategic market for Novanta.

We are excited about the next step and how it connects us with our customers and our growth capabilities ---

To meet the harsh applications of the minimally invasive surgery market.

The final phase of the plan will enter 2020 per cent in 2019.

As we discussed before, in order to really solve the gross margin problem of WOM, we think we need a low

Manufacturing facilities to address the growing cost of WOM medical consumer goods.

While we have increased our resources during the quarter and started to develop more specific plans, we are better able to talk about this phase of the project in 2019.

The last topic on gross margin is the impact of the recently enacted tariffs, mainly tariffs between the United StatesS. to China.

While we see from these tariffs that the incremental costs of the supply chain are small, we are confident that we can mitigate these increases by replacing suppliers, or pass on these costs to our customers in the form of a surcharge.

However, when tariff costs are passed to us from our suppliers, there may be a time difference with the time when we are able to pass these costs to our customers.

But we don\'t expect incremental costs to exceed $1 million in the short term.

Next, the cost of R & D in 2018 was $12. 6 million or 8.

3% of sales, $9 million or $7.

6% of sales last year.

The percentage of R & D revenue is lower than expected due to higher revenue providedthan-

Expected sales for the quarter.

We continue to make strong progress in recruitment, our new product introduction program is making great progress, and we continue to anticipate that R & D will accelerate in the second half of 2018.

SG & A costs $29 for the second quarter.

2 million or 19% of sales.

That\'s $23, by contrast.

8 million or 20% of sales in the previous year.

Most of SG & A\'s expenses have increased over the past 12 months due to acquisitions.

GAAP operating income is $17.

Compared to $15, it was 1 million per cent in 2018.

7 million in the previous year, not

GAAP operating income is $25.

Sales were 9 million or 17% compared to $22. 4 million or 18

8% of sales last year.

Adjusted EBITDA increased 18% year on yearover-year at $30. 4 million or 20

2% of sales in the second quarter of 2018.

By contrast, it\'s $25.

The previous year was 7 million.

Interest payments for the quarter were $2.

$6 million to $1.

The previous year was 4 million.

The weighted average interest rate of our senior credit institution is 3.

The second quarter of 2018 was 7%.

On the tax side, the GAAP rate is 20.

The second quarter of 2018 was 8%.

It is different from Canada\'s statutory interest rate of 29%, which is mainly due to the jurisdictional combination of income and changes in the United StatesS. tax laws. On a non-

According to accepted accounting principles, our tax rate for the second quarter was 19.

8%, which is driven by a favorable jurisdictional portfolio of income and preferential interest rates from the United StatesS.

Tax Cuts and Jobs Act.

When looking at the full year, we see that due to further jurisdictional portfolio changes and continued support from the United States, the normalization of tax rates is around 20% to 21%S. Tax Reform.

On GAAP, the diluted earnings per share are $0.

Compared to the diluted earnings of $0 per share, the quarterly earnings were $32.

The second quarter of 2017. On a non-

Adjusted earnings are $0 based on accepted accounting principles.

The first quarter was $51, up from $0.

41 of the previous year.

Adjusted annual earnings per share growth-over-

Strong business performance and acquisitions contributed to this year\'s growth.

We ended the quarter with 35 points.

The weighted average tradable shares of 5 million compared to 35.

The second quarter of 2017 was 5 million.

Our operating cash flow for the quarter was $20 million, compared to $16.

The second quarter of 2017 was 8 million.

This is driven by higher profitability and lower demand for working capital.

Capital expenditure is about $4.

3 million, increased from $1.

The second quarter of 2017 was 4 million.

This expenditure level is higher than our historical average and is driven by capital expenditures for prior communication related to the expansion of manufacturing facilities in our precision sports business.

We ended 2018 of the second quarter with a total debt of $0. 24 billion and a combined leverage ratio of 1.

99, defined as total debt divided by the projected EBITDA for rolling 12 months, while our net debt is $132.

By the end of the second quarter, 9 million.

Turn to guidance.

We look forward to the whole year of 2018 ~-

Update the guidance we provide you in the late five of this year.

We now expect GAAP revenues to be approximately $0. 6 billion to $0. 607 billion, representing approximately 15% to 16% of reported growth, 5. 5% to 6.

Organic growth was 5% per cent compared to 2017.

Depreciation expenses are expected to exceed $11 million, and amortization costs are expected to be approximately $26 million for the whole year.

We now expect the Adjusted EBITDA for the full year of 2018 to be between $0. 121 billion and $0. 125 billion, or about 20% of sales. We expect adjusted earnings per share for the full year of 2018 to be within the range of $1. 96 to $2. 02 per share.

It was transferred to 2018.

We expect GAAP revenue to be between $0. 153 billion and $0. 156 billion.

As mentioned earlier, due to our WOM business unit, the growth in the second half of 2018 was close to an organic increase of 5%, which was very difficult compared to the second half of 2017, as regulatory changes in 2017 pushed sales higher than expected.

As Matthijs mentioned in his speech, this is a temporary challenge as the business will revert to Novanta growth rates in early 2019 and is in line with the global patient procedure growth rate.

The adjusted gross profit margin will continue to rise in turn, which is expected to be around 45.

5%, the overall operating expenses are expected to account for about 28% of sales.

The estimated depreciation cost is about $2.

8 million, while Amortization costs are expected to be approximately $6. 5 million.

Interest expenditure is expected to be about $2.

5 million was 2018 per cent in the third quarter.

In terms of taxes, we expect the third quarter

The GAAP tax rate is about 22% to 23. 5%.

For the adjusted EBITDA, we expect the price range to be $31 million to $33 million.

Finally, we expect the adjusted EPS to be in the range of $0. 50 to $0.

53 compared to $0.

Third quarter of 2017 45.

The diluted weighted average stock issued will be roughly the same as the second quarter.

As always, our guidance will not have any significant impact on exchange rate changes.

We are proud of the progress and strong performance of our organization so far this year.

We look forward to fulfilling our commitment to our employees, customers and shareholders.

This concludes the prepared speech.

Let\'s start asking questions now. Question-and-

[Answer]

Operation instructions].

The first question comes from Lee Jagoda of CJS Securities.

Lee Jago Dassault has just begun the visual part.

I know that JADAK is a drag on your organic growth and it looks like there is some organic decline in the department itself in general.

Assuming all the drops are JADAK, can you talk about some positive offsets and outlook for the rest of the year?

Robert Buckley. yes.

I mentioned it just now, Li, as expected.

Therefore, we have had several quarters of communication on the headwinds of jadak.

Next quarter, we will see the headwinds of diabetes care, and we are expected to bring the business back to growth.

It is supported by the design we see in the business to win momentum.

It is supported by the RFID momentum we see in the business and is supported by the back office

Our position in business.

Again, in line with what we have said before, we still keep track of the story.

Lee Jagoda

Then Robert, I know you mentioned that you are planning to withdraw from the non-core non-medical product line within WOM.

Can you give us some insight on the income and profitability of your exit? -

Those lost sales and all the profitability that could be lost are within the revenue and EPS range you provide throughout the year?

Robert Buckley. yes.

As a result, annualized income was between $3 million and $5 million.

It has been incorporated into our revenue projections and has been incorporated into our EBITDA and EPS forecasts for 2018.

So in general, I think you already have the advantage of the overall business, which can not only cover up the fact that we are doing this.

From the perspective of profitability, this is not high

What I want to say is the margin business. So it is a --

A little more revenue impact than profit.

Is it profitable?

Robert Barkley is a little bit, but in most cases we can take--

Or absorb the lost profits from it.

So this has been taken into account in the forecast.

Lee in Jagger dapper Fett

My last one on the laser quantum.

It looks like your exit is less profitable than in the previous quarters.

Can you give us some easy tracks? -

Color on the business track, or is there any impact on profitability this quarter?

Robert bucklino, not from a profit perspective.

This is a consistent decline in sales.

There are ups and downs here, they are--

Frankly, they depend on our other business portfolio with other customers. It depends --

As you know, if my focus is on a customer,--

If there is any change between product lines, this can lead to some--

Or individual products, which may lead to some changes in profitability.

The next question comes from Richard isoperatorthe Baird.

Richard Eastman is just trying to finish the last question.

With the JADAK situation and then in vision I can feel that with the WOM review they had some really tough competition in the second half.

In jadak, we expect growth to resume in the second half of the year.

But just as you consolidate 2 in the second half of the year, will the vision see any core growth?

I mean, is the second half better than 0?

Robert Barkley, we haven\'t talked about the specifics yet.

I think there will definitely be some challenges there.

So from the perspective of organic growth,-

The decline in WOM is more important than the increase in JADAK.

So there will be some challenges there.

But in our view, this is very temporary.

I would say that Matthijs GlastraYes, it is consistent and is temporary.

I mean, I think we \'ve been talking about this more or less since last year.

Therefore, this is the guiding or forecasting factor that we take into account in the process of running the business.

Okay, Richard Eastman.

In Q, there are some references in vision--

Gross margin of poor quality impact. Is that --

What does this mean?

Matthijs glastrapretica mobile, I think.

The visual part you\'re talking about is Robert Barkley?

Or the entire company of Richard eastmannis.

Robert Barkley of the whole company, there are some poor quality costs for Precision Sports, which we just mentioned in the script.

But specifically, in the visual part, only--

I just want to say that the existing manufacturing process within WOM is still going through some mature stages.

The most important impact of Ray nash is the mixing effect of higher mixing in consumables, right?

This is the main impact of WOM.

Robert Barkley our business is growing very fast with a slightly lower gross margin, so just take care of it.

Richard eastmanoko

I can ask that the core growth rate we have there is very good in precision motion.

I\'m curious about Celera Motion, is Celera Motion more powerful than these end markets in medical robotics and industrial robotics, or is it reasonably balanced?

Matthijs GlastraYes, so the surgical robot is definitely strong, but driverless vehicles, satellite communications, in general, what I call the trend of mobile robots everywhere-

These are all a variety of applications for driverless cars, so in the comments I have prepared, this is one.

Not only do we provide something on the upper level

In these applications, the final performance range of the motion function itself, but we also provide pointing and tracking capabilities because of these-

These, call--

These vehicles need to know where they are.

They need to be able to fully digitize their environment and they need some very accurate pointing and tracking devices to point and track signals or lights-

In fact, it also has the ability to exercise precisely.

One of them, called, point and tracking devices, is called gimbals, and we are in a unique position in this area, so we actually see some momentum that design has won.

But this is in a variety of applications on the factory floor, in the air and even under water.

So it has a lot of different applications.

Richard eastmanoko

Then the last question is to talk to photon for a while.

Two things, I mean.

Similarly, as the core grows, is the laser quantum of 11% greater or less than that of Cambridge technology?

In other words, how did these two come in relative to the overall photon growth rate of 11%?

University of Cambridge is doing--

To be fair, the University of Cambridge is doing better, but the laser quantum is not far away.

But Cambridge did do better.

Matthijs GlastraYes, so we are very excited about the performance of Cambridge technology, we think Cambridge technology is very strong and continues to be strong.

Laser Quantum, which we said last year in a very spectacular context, we are developing something stronger and harder, so after the launch dynamics, over time, normalize the growth of the business to the Novanta average, right?

So I think we are very consistent in terms of trajectory.

Now, if you look at it in the medium and long term for years of application, this is a very definite grower for us.

So we are still very excited about it.

Richard Eastman\'s done.

Have some reading-

Through your comments [indiscernible]put out.

But there\'s some reading

Comments on China and Europe\'s heavy industry laser market through IPGP.

I\'m just curious if you have any comments.

I know that Cambridge Tech won\'t necessarily play a role in this heavy industry cutting and welding market.

Still, I\'m curious if you see any problems or minor problems or any needs in the Laser Market, in the industrial laser market you compete.

Matthijs GlastraYes. No, thank you.

Obviously we don\'t comment on others, we can only comment on what we see.

I mean, we are very diverse as a company.

So I even commented in the script that like business, like Cambridge technology, we call it horizontal technology business.

It spans many, many applications.

As a result, at the company level, no individual has applied for more than 10% of sales.

We don\'t have any major customer focus.

The largest customers are between 5% and 7%, and the number of our customers is very limited.

So I will start with this dynamic because it is a very important aspect.

Besides, you are very right.

We have very little contact with cutting and welding.

So, yes, we don\'t see any dynamics.

What I can comment on is that we see strong growth in all regions, so China is still good for us.

Of course, we are observing the dynamics of trade. of course, things will change a lot ---

The environment is very unstable now.

But so far, we have not seen any changes in the momentum of growth, nor have we seen a significant impact on our supply chain.

We look forward to the second half of the year.

As we said, we have not seen any major changes in demand.

Now, if we look at the semiconductor side, there are already some reports that some areas may slow down.

We did not see that. Again this --

Exposure to the semiconductor market is quite low, less than 10% of sales, and our exposure is actually growing at a faster rate --

Growth, which is part of the longer term of the market, is an extreme UV or application related to 5g deployments or electric vehicles. So --

As you can imagine, these are all increasing.

So we are also looking at this, but so far we have not seen any significant impact of the weakening of the market.

The next question comes from Brian Blanche of William Blair.

Brian DrabSo I think it is clear that you are updating your expectations for the combined gross profit margin for this year.

Last quarter, you were still talking about an expansion of 100 basis points.

I don\'t know if I missed it, but can you give a more accurate picture of gross margin expectations for this year?

Robert Buckley, no, we haven\'t figured it out yet.

I thought we \'d see it in the fourth quarter. -

Start to see improvements of 100 basis points-

On the basis of the operating rate with 2017.

But this is really-

The effective situation in the first half of this year is that our medical consumables grow faster and the profit margin is lower. Therefore, they have made considerable mixed changes in the business, right?

So in the photon field, you will see some good profit expansion.

I think there will still be some very good profit expansion for the precision sports business this year --over-year.

These two--

But the business there is healthy.

But when you get into the vision area, you get growth in areas with low margins, which leads to this mixed change. Brian DrabOkay.

Then Robert, you say 45.

Gross profit margin for the third quarter is 5%?

It\'s Robert Buckley. I did.

Okay, Brian Delak.

Just check.

And then in the long run, if you look ahead to 2019, is the expectation of an expansion potential of 100 basis points still intact?

Is this still the plan?

Yes, the plan is still like this.

I think if we don\'t have some cost of poor quality in the precision movement section, you will see a little higher this quarter.

This will recover when it enters the third quarter.

But I think it\'s still complete.

This is still something we think is very capable of doing.

Brian drabok, great.

And then a little more--

I am looking for more granularity on the model.

I don\'t know how much you\'re willing to pay.

But in terms of R & D spending, in terms of the dollar, have we reached a level that should be relatively stable for at least the next few quarters?

Can you then tell us what tax rates will be used in the future?

I know you made some comments on the tax rate, but I thought--

I am looking for a figure similar to the fourth quarter and also looking for 2019.

From the tax rate point of view, I am talking about 22% to 23. 5%.

That\'s what we should see next quarter.

This is also what it should be in the fourth quarter.

So if you take this into account, it will lead to a reduction in the tax rate this year-

More than we originally expected.

You can do math on it.

But I think it\'s--

I think we feel good about this place.

From the R & D perspective, it\'s going to rise from the dollar perspective, so no, you shouldn\'t expect it to stay at 12. 5.

It will prompt--

I think there will also be an increase in the percentage of sales, so that\'s what we plan.

We have been adding additional engineering resources there and we have been focusing on taking it up to nearly 9%.

I think that is still our goal when we look back on the second half of the year.

In general, operating expenses, we say we will make up about 28% of sales in the third quarter, so this should give you a little perspective.

Brian drabok did help.

And then my last thing.

When is the time to peel off this $3 million to $5 million WOM revenue?

Is this happening immediately?

First of all, Robert Barkley will has taken this into account in his forecast.

This is not necessarily stripping.

We just closed the third one.

Party sales we do. -

This is related to the type of processing of the function. So we\'re not --

This has been taken into account in our forecast.

We have experienced a little in the second quarter. You should --

We will continue to anticipate this impact in the third and fourth quarters.

So this obviously has a little impact on organic growth, so like there\'s a hard comparison, we\'re adding to that as well.

But I think it\'s a right decision in general.

It will increase the many capabilities of the business, improve the profit situation, and allow us to increase some efficiency, thus further expanding the profit to 19 and 20 years. Brian DrabOkay.

The last question is, under your guidance, when did this question begin to be considered?

The first time we thought about it was this quarter, yes.

We had a little impact, but first of all-

This is really the first time in the year to consider ,[indiscernible]right now.

Ray NashYes, has had little impact on the quarter.

More is the second half.

This is the end of our problem. and-answer session.

I want to hand over the meeting back to Sir.

Any conclusion of Matthijs Glastra.

Thank you, operator.

All in all, 2018 is another solid quarter.

We focus on accelerating earnings growth, and the diversity and strength of our business is reflected in our strong financial performance.

We see a trend of convergence, supported by the macro trend of industry 4, where we need our motor, visual and optical capabilities in a variety of applications.

0. productivity of precision medical care and health care.

So we continue to be excited about our app and the positions we have.

Our growth strategy is reasonable, based on a variety of growth drivers, organically achieved through mergers and acquisitions, and we are moving in the strategic direction of 2020.

Finally, I would like to thank our customers, employees and shareholders for their support.

I am particularly grateful for the strong contribution and execution of our team of staff at novanta.

It is a real pleasure and honor to lead this great company.

Thank you for your attention to the company and for your participation in today\'s conference call.

I look forward to joining our third quarter earnings call in a few months.

Thank you very much.

The call is now postponed.

The meeting is over now.

Thank you for attending today\'s speech.

You can disconnect now.

August 8, 2018 morning 10: 00 2018 quarter earnings call

Company finance supervisor

Robert Buckley, CEO and director

Cfoanalystlee Jagoda-

Richard Eastman-Robert W. Baird & Co. Brian Drab -

Good morning, William Blair.

My name is Andrew. I will be your conference operator today.

I would like to welcome you all to Novanta Inc at this time.

2018 Second quarter earnings call. [

Operation instructions].

Please note that this activity is being recorded.

I want to hand over the meeting to Sir now.

Ray Nash, head of corporate finance

Please continue.

Ray NashThank you a lot.

Good morning, welcome to the 2018 earnings call for the second quarter of Novanta.

I\'m Ray Nash, head of corporate finance at Novanta.

Today\'s call is Matthijs Glastra, our chief executive;

And our chief financial officer, Robert Barkley.

If you do not receive a copy of our earnings press release released today, you can get it from the Investor Relations section of our website. novanta. com.

Please note that this call is live webcast and will be archived on our website shortly after the call.

Before we start, we need to remind everyone of the safe harbor ahead --

The earnings press release we released earlier today and the statement outlined in the SEC document.

We may make some comments today in our prepared statements and answers to questions, which may include forwarding --

Look at the report.

These include inherent assumptions of known and unknown risks and other factors that may lead to significant differences in our future results from our current expectations. Any forward-

The forward-looking statements made today represent only our views.

We do not assume any obligation to update forward.

Even if our estimates change, you should not rely on these forward-looking statements

At any time after this call, look for statements to represent our point of view.

In this call, we will mention some non-

GAAP Financial indicators.

For this non-

The GAAP financial measures that are most directly comparable to the GAAP measures can be used as an attachment to our revenue press release.

What we use

During this call, GAAP financial measures are inconsistent with the GAAP measures in the earnings press release, and we will provide timely reconciliation in the Investor Relations section of our website after the call.

I am now pleased to introduce Matthijs Glastra, Novanta\'s chief executive.

Thank you, Ray.

Good Morning, everyone. thank you for joining us.

Novanta continued to maintain its momentum, surpassing us in terms of revenue and profit guidance, achieving another strong quarter.

Our company delivered $150.

4 million of revenue, 26%-over-

Annual report revenue growth 6. 2% year-over-

Organic income growth.

This is our seventh consecutive quarter. or high single-digit double --

Organic growth.

Our Adjusted EBITDA is $30.

4 million, an increase of 18% over last year.

Our adjusted earnings per share are $0.

51, up 24% from $0.

The second quarter of 2017 was 41.

In addition, we provide steady cash flow, operating cash flow increased by 19% year on year. over-

The second quarter of this year reached $20 million.

At Novanta, our mission is to provide important innovation and mission-

While improving end-user productivity and improving people\'s lives, provide key features to our OEM customers.

We believe that the strength of our team, our strong business model and diversified applications, as well as balanced contact in the medical and advanced industrial markets, provide us with good service.

We see a trend of convergence and need to implement our motor, visual and optical capabilities in a variety of applications supported by the macro trend of industry 4.

0. productivity of precision medical care and health care.

As a result, we continue to be excited about our location and applications, such as DNA sequencing, robotic surgery, metrology, advanced material processing and precision automation, as well as robotic technology, with long-term support

Long-term market growth trend.

We continue to see this quarter

Based on the growth momentum of the company and all regions, all 3 operations showed double growthdigit year-over-

Annual report revenue growth.

We also continue to maintain stable order performance for the overall book. to-bill of 1.

04 after strong booking performance in the first quarter.

What we see is

Based on market growth in life sciences, minimally invasive surgery, and advanced industries, our growth in any given quarter is more driven by customer technology releases or stages --

Market dynamics are greater than structural in phase-out.

We continue to make strong progress on strategic growth priorities and promote long-term

Achieve organic growth through business excellence and innovation.

Annual revenue for new products-to-

The year has doubled. over-year.

Our vitality index is revenue from new products launched in the past 4 years and now exceeds 20% of sales. Our year-to-

Date design wins grew by more than 25%, and our revenue from China grew by more than 30% in the second quarter compared to last year.

We believe these indicators support us.

Long-term organic growth guidance of an average of 5% to 7%.

In terms of productivity, I am proud of the execution of the team and have made a solid contribution to our operational savings.

We are starting to see some of the preliminary effects of the recent tariff changes, but we expect to either reduce the cost or pass the cost on to the customer, so, we do not believe that this impact will have a significant impact on our bottom line.

We\'ll hear more details from Robert about the quarterly and annual outlook, but strong second-quarter results give us confidence in the outlook for the full year of 2018.

In terms of M & A, we reported a good Tucker-

In the acquisition, Zettlex announced an early end at a previous earnings call.

The integration of Zettlex went well and our customers and sales team responded positively as we are deploying Zettlex\'s induction encoder technology through our precision motion sales channels.

The inductive encoder technology is ideal for industrial robots and medical applications, so we think it has greatly expanded our addressable market.

We expect the acquisition of Zettlex to be

The long-term growth trajectory of our Celera Motion business.

Our balance sheet is strong, with sufficient firepower and healthy acquisition channels.

In terms of acquisitions, we maintain discipline, focus on cash and cash returns and accelerate the long term

Long-term growth in target markets.

Now let me talk about our operations.

Our precision sports sector continues to be our strong growth engine at 20% years. over-

A year of revenue growth and stable ordersto-bill of 1.

Quarter 08.

Before that, we discussed that our precise and dynamic motion control functions play a good role in multiple markets with structural growth dynamics, such as precision automation, robotics, metrology, automation

We see a broader trend of mobile robots everywhere, online, factory ground, in the air and underwater, with embedded precision measurement and detection capabilities that enable big data and full digitalization.

In addition to being able to move precisely above

The final performance range of these robots, these applications typically include complex pointing and tracking devices such as frameworks that require precise motion solutions.

These solutions require small size, light weight, energy saving

Able to operate efficiently in demanding environments.

Thanks to our ability to design and deliver the best combination of high precision, performance, power and compact form factor, we are in the best position and win here, enables our customers to create pointing and tracking features in a variety of application and operating conditions.

In the precision motion section, year-to-

Our new product revenue has grown by more than 50% so far, and our Chinese revenue has grown by more than 40% compared to last year as we are bringing new innovations to market and are expanding our business

As we reported earlier, we invested. -

Invest in business, innovation and operational capabilities to drive sustainable growth in this attractive business.

The team is steadily addressing the supply chain issues we previously reported, and while delivery performance has improved significantly, our gross profit margin has not improved as quickly as we originally expected, because we are solving some of the remaining manufacturing inefficiencies for the rest of the year.

The team knows what to do, and now is the time to complete the task.

Turning to our photon sector, which achieved revenue growth in the 11% quarter --over-year.

Growth is driven primarily by our beam delivery business as a result of strong commercial execution in an ever-improving industrial environment. Our book-to-

Annual performance-to-date was 1. 02.

So far, revenue from new products has increased by more than 40% over last year.

Powerful applications are made of laser additives, through

Drilling, Micromachining and October.

We are very pleased to see the continued growth and operational execution of our Cambridge technology business, which once again provides record bookings and revenues with a broad momentum across multiple applications.

The team has done a lot of work on-demand execution and business diversity, while improving the core of the overall product in demanding applications.

The breadth of Cambridge apps and customers provides us with a more sustainable and predictable revenue stream.

Due to our proprietary beam steering technology packaged with customers or applications, we won the Cambridge technology business

Specific solutions that enable our customers to win at the fastest, most accurate and highest speed

Efficient solution.

The core technology of Cambridge is the horizontal technology business, which spans many advanced industrial medical markets.

It has nothing to do with which laser power supply or wavelength to use, which makes it a great business

Diversified growth potential.

In the second quarter, Cambridge technology launched

Generation ProSeries Plus 3-

Axis scanning head series of laser exhibition.

These products are mainly used for demanding large-scale on-site micro-processing, laser additive manufacturing and conversion applications.

The ProSeries Plus series provides reliable solutions for long processing runs and extends adjustment options to meet application needsspecific needs. These next-

Generation models provide better accuracy and flexibility for our OEM customersin-

Stable class with high comprehensive abilitypower lasers.

Laser Quantum has a solid quarter and is a powerful contributor to the results of photons.

As we reported on previous calls, following the huge growth of last year\'s new generation of DNA sequencing machines, the growth of this business has begun to normalize to the average growth rate of Novanta.

We are still very positive about the medium term. and long-

Long-term prospects for this business-

Because we believe that the space for DNA sequencing is attractive, our leadership is strong.

Finally, we are satisfied with the productivity, operations and hybrid execution in the photon field, as evidenced by Gross profit margin performance.

Turn to our visual field, including two businesses of minimally invasive surgery technology or MIS;

And detection analysis.

The MIS group includes endoscopy and WOM, focusing on applications for endoscopic and robotic surgery.

The testing and analysis team includes our JADAK business, focusing on reducing medical errors, improving workflow and patient outcomes in applications such as minimally invasive surgery, patient monitoring, life sciences and clinical laboratory equipment.

In the second quarter, our vision Department achieved 58%. over-

Annual revenue growth driven primarily by the acquisition of WOM.

New product revenue in the second quarter more than doubled from last year. The book-to-

Bill in our visual section is 1.

Good booking in MIS.

Our WOM business continues to be hugely attractive in terms of infiltrating new customers, driving new product launch initiatives, and strategically focusing our business on the core competencies of minimally invasive surgical applications.

During the quarter, the business announced its intention to withdraw from its non-core and non-medical product line to reduce the asset strength of the business while increasing its strategic focus on pure medical applications.

The plan will enable businesses to make better use of their growth opportunities.

Despite the fact that changes in European regulation in 2018 led to more difficult times in the second half of 2017, WOM continued to perform as we expected and is expected to achieve the average growth rate of Novanta in 2019.

The recently launched insufflator and pump products from WOM have shown good momentum among manufacturers of endoscopic OEMs.

In addition, we have seen a very strong expansion in their consumer goods business, which, as we explained earlier, has a gross margin of less than the capital equipment business.

Our plan to solve this problem is still on track.

We increased our resources in the quarter and started to develop specific plans, including low

Drive improved cost manufacturing capabilities in 2020 and beyond.

While the business will drag on gross margin in the next two years, we are excited about the opportunity to significantly increase gross margin, and we see and expect to see strong organic growth in the coming years, and the non-cyclical nature of the business.

We are also satisfied with the continued development of the NDS product line.

NDS for the sixth consecutive quarter in the first quarterover-

Driven by 4 k displays, wireless products and new products such as our new video image management and collection products for the integrated operating room market, annual core revenue growth.

In addition, the business has significantly improved profitability and is expected to be a net contributor to our revenue and profit growth in 2018.

Finally, in line with our previous earnings call, our testing and analysis business has seen a decline in organic revenue driven by the old legacy product line and regulatory and reimbursement changes in diabetes care.

We are working to overcome these adverse factors and expect the business to resume growth in the second half of the year.

Still, we see great design wins in the detection and analysis business

The revenue of RFID is rapid.

In the second quarter, we launched

Compact programmable 4-

The antenna port, known as IZAR, is a uhf rfid reader.

This product extends our addressable market to those that need high

Perform RFID reader solutions with minimal engineering integration work.

The reading rate of IZAR reader is over 750 labels per second and the reading range is over 9 m, which makes it ideal for medical and industrial asset tracking, inventory control, smart medical cabinets and access control.

This product is a great example of integrating software and middleware-based intelligence into a complete module that can be seamlessly integrated with our OEM customers.

Early customer response was very positive and the launch momentum of this product was advanced, so we were very excited about the potential here.

As mentioned earlier, the demand for RFID in healthcare is increasing as more and more people need to identify, track and connect devices, drugs and patients to achieve optimal workflow and patient safety.

Thanks to our high attention in the medical market, we believe that we are uniquely positioned to take advantage of this opportunity and see this through the growing demand for our business.

At the end of my section, we were very pleased with the organic revenue growth and profitability we achieved in the second quarter.

We are confident in the 2018 outlook as Novanta\'s leadership in key medical and industrial markets, coupled with a rigorous M & A approach, provides a very solid foundation for sustainable profitable growth.

So I\'m going to transfer the call to Robert to provide more details on our financial performance. Robert?

Robert BuckleyThanks, Matthijs, good morning.

We paid $150.

Revenue in the second quarter of 2018 was 4 million, up 26 year on year.

The report is based on 3%.

Our acquisition has increased revenue by $21. 8 million or 18

3%, the exchange rate of foreign exchange has a favorable impact on our income of US $2. 1 million or 1. 8%.

Organic Growth 6. 2% year-over-year.

The gross profit of 2018 GAAP in the second quarter was $65.

2 million or 43% of sales.

By contrast, $53. 5 million or 44.

9% of sales in the second quarter of 2017. On a non-

The adjusted gross profit for the second quarter was $67, 2018.

Sales were 7 million or 45% compared to $55.

The second quarter of 2017 was 2 million, or 46%.

The adjusted gross profit margin increased in turn, but due to the reduction in gross profit margin in our vision department, the gross profit margin was below 2017.

The vision part gross margin is driven by a higher combination of WOM medical consumer goods sales, which is not part of the previous year\'s performance.

As we explained before, the gross profit margin of the medical consumables business is much lower, so the strong growth of the product line will have a negative mixed effect.

However, we are very excited about the opportunity to increase profit margins here.

We understand what actions need to be taken this quarter and have added resources to the business to start working on more specific plans.

In fact, in the second quarter, we announced the first phase of the 2018 restructuring plan.

The whole project will focus on improving the manufacturing efficiency of our vision operations division to raise the gross margin to the Novanta average.

The focus of the first phase is to rationalize our non-core business, in which case the focus is on stopping the processing of non-medical products to non-medical customers in the WOM business unit.

While our annual income has grown from around $3 million to $5 million, we see this decision as a way to increase the strategic focus of the medical businessonly products;

Improve the organization\'s capacity to expand the manufacture of medical products;

Reduce the asset strength of the business;

Finally, let the enterprise on the road to increase the gross profit margin.

The second phase, which we would like to discuss in more detail in the next earnings release, will focus on maximizing the use of our German manufacturing center to create a German-

The headquarters is located in the center of excellence manufacturers.

One of the core principles of acquiring WOM is to increase our influence and competitive power in Germany, which is an important strategic market for Novanta.

We are excited about the next step and how it connects us with our customers and our growth capabilities ---

To meet the harsh applications of the minimally invasive surgery market.

The final phase of the plan will enter 2020 per cent in 2019.

As we discussed before, in order to really solve the gross margin problem of WOM, we think we need a low

Manufacturing facilities to address the growing cost of WOM medical consumer goods.

While we have increased our resources during the quarter and started to develop more specific plans, we are better able to talk about this phase of the project in 2019.

The last topic on gross margin is the impact of the recently enacted tariffs, mainly tariffs between the United StatesS. to China.

While we see from these tariffs that the incremental costs of the supply chain are small, we are confident that we can mitigate these increases by replacing suppliers, or pass on these costs to our customers in the form of a surcharge.

However, when tariff costs are passed to us from our suppliers, there may be a time difference with the time when we are able to pass these costs to our customers.

But we don\'t expect incremental costs to exceed $1 million in the short term.

Next, the cost of R & D in 2018 was $12. 6 million or 8.

3% of sales, $9 million or $7.

6% of sales last year.

The percentage of R & D revenue is lower than expected due to higher revenue providedthan-

Expected sales for the quarter.

We continue to make strong progress in recruitment, our new product introduction program is making great progress, and we continue to anticipate that R & D will accelerate in the second half of 2018.

SG & A costs $29 for the second quarter.

2 million or 19% of sales.

That\'s $23, by contrast.

8 million or 20% of sales in the previous year.

Most of SG & A\'s expenses have increased over the past 12 months due to acquisitions.

GAAP operating income is $17.

Compared to $15, it was 1 million per cent in 2018.

7 million in the previous year, not

GAAP operating income is $25.

Sales were 9 million or 17% compared to $22. 4 million or 18

8% of sales last year.

Adjusted EBITDA increased 18% year on yearover-year at $30. 4 million or 20

2% of sales in the second quarter of 2018.

By contrast, it\'s $25.

The previous year was 7 million.

Interest payments for the quarter were $2.

$6 million to $1.

The previous year was 4 million.

The weighted average interest rate of our senior credit institution is 3.

The second quarter of 2018 was 7%.

On the tax side, the GAAP rate is 20.

The second quarter of 2018 was 8%.

It is different from Canada\'s statutory interest rate of 29%, which is mainly due to the jurisdictional combination of income and changes in the United StatesS. tax laws. On a non-

According to accepted accounting principles, our tax rate for the second quarter was 19.

8%, which is driven by a favorable jurisdictional portfolio of income and preferential interest rates from the United StatesS.

Tax Cuts and Jobs Act.

When looking at the full year, we see that due to further jurisdictional portfolio changes and continued support from the United States, the normalization of tax rates is around 20% to 21%S. Tax Reform.

On GAAP, the diluted earnings per share are $0.

Compared to the diluted earnings of $0 per share, the quarterly earnings were $32.

The second quarter of 2017. On a non-

Adjusted earnings are $0 based on accepted accounting principles.

The first quarter was $51, up from $0.

41 of the previous year.

Adjusted annual earnings per share growth-over-

Strong business performance and acquisitions contributed to this year\'s growth.

We ended the quarter with 35 points.

The weighted average tradable shares of 5 million compared to 35.

The second quarter of 2017 was 5 million.

Our operating cash flow for the quarter was $20 million, compared to $16.

The second quarter of 2017 was 8 million.

This is driven by higher profitability and lower demand for working capital.

Capital expenditure is about $4.

3 million, increased from $1.

The second quarter of 2017 was 4 million.

This expenditure level is higher than our historical average and is driven by capital expenditures for prior communication related to the expansion of manufacturing facilities in our precision sports business.

We ended 2018 of the second quarter with a total debt of $0. 24 billion and a combined leverage ratio of 1.

99, defined as total debt divided by the projected EBITDA for rolling 12 months, while our net debt is $132.

By the end of the second quarter, 9 million.

Turn to guidance.

We look forward to the whole year of 2018 ~-

Update the guidance we provide you in the late five of this year.

We now expect GAAP revenues to be approximately $0. 6 billion to $0. 607 billion, representing approximately 15% to 16% of reported growth, 5. 5% to 6.

Organic growth was 5% per cent compared to 2017.

Depreciation expenses are expected to exceed $11 million, and amortization costs are expected to be approximately $26 million for the whole year.

We now expect the Adjusted EBITDA for the full year of 2018 to be between $0. 121 billion and $0. 125 billion, or about 20% of sales. We expect adjusted earnings per share for the full year of 2018 to be within the range of $1. 96 to $2. 02 per share.

It was transferred to 2018.

We expect GAAP revenue to be between $0. 153 billion and $0. 156 billion.

As mentioned earlier, due to our WOM business unit, the growth in the second half of 2018 was close to an organic increase of 5%, which was very difficult compared to the second half of 2017, as regulatory changes in 2017 pushed sales higher than expected.

As Matthijs mentioned in his speech, this is a temporary challenge as the business will revert to Novanta growth rates in early 2019 and is in line with the global patient procedure growth rate.

The adjusted gross profit margin will continue to rise in turn, which is expected to be around 45.

5%, the overall operating expenses are expected to account for about 28% of sales.

The estimated depreciation cost is about $2.

8 million, while Amortization costs are expected to be approximately $6. 5 million.

Interest expenditure is expected to be about $2.

5 million was 2018 per cent in the third quarter.

In terms of taxes, we expect the third quarter

The GAAP tax rate is about 22% to 23. 5%.

For the adjusted EBITDA, we expect the price range to be $31 million to $33 million.

Finally, we expect the adjusted EPS to be in the range of $0. 50 to $0.

53 compared to $0.

Third quarter of 2017 45.

The diluted weighted average stock issued will be roughly the same as the second quarter.

As always, our guidance will not have any significant impact on exchange rate changes.

We are proud of the progress and strong performance of our organization so far this year.

We look forward to fulfilling our commitment to our employees, customers and shareholders.

This concludes the prepared speech.

Let\'s start asking questions now. Question-and-

[Answer]

Operation instructions].

The first question comes from Lee Jagoda of CJS Securities.

Lee Jago Dassault has just begun the visual part.

I know that JADAK is a drag on your organic growth and it looks like there is some organic decline in the department itself in general.

Assuming all the drops are JADAK, can you talk about some positive offsets and outlook for the rest of the year?

Robert Buckley. yes.

I mentioned it just now, Li, as expected.

Therefore, we have had several quarters of communication on the headwinds of jadak.

Next quarter, we will see the headwinds of diabetes care, and we are expected to bring the business back to growth.

It is supported by the design we see in the business to win momentum.

It is supported by the RFID momentum we see in the business and is supported by the back office

Our position in business.

Again, in line with what we have said before, we still keep track of the story.

Lee Jagoda

Then Robert, I know you mentioned that you are planning to withdraw from the non-core non-medical product line within WOM.

Can you give us some insight on the income and profitability of your exit? -

Those lost sales and all the profitability that could be lost are within the revenue and EPS range you provide throughout the year?

Robert Buckley. yes.

As a result, annualized income was between $3 million and $5 million.

It has been incorporated into our revenue projections and has been incorporated into our EBITDA and EPS forecasts for 2018.

So in general, I think you already have the advantage of the overall business, which can not only cover up the fact that we are doing this.

From the perspective of profitability, this is not high

What I want to say is the margin business. So it is a --

A little more revenue impact than profit.

Is it profitable?

Robert Barkley is a little bit, but in most cases we can take--

Or absorb the lost profits from it.

So this has been taken into account in the forecast.

Lee in Jagger dapper Fett

My last one on the laser quantum.

It looks like your exit is less profitable than in the previous quarters.

Can you give us some easy tracks? -

Color on the business track, or is there any impact on profitability this quarter?

Robert bucklino, not from a profit perspective.

This is a consistent decline in sales.

There are ups and downs here, they are--

Frankly, they depend on our other business portfolio with other customers. It depends --

As you know, if my focus is on a customer,--

If there is any change between product lines, this can lead to some--

Or individual products, which may lead to some changes in profitability.

The next question comes from Richard isoperatorthe Baird.

Richard Eastman is just trying to finish the last question.

With the JADAK situation and then in vision I can feel that with the WOM review they had some really tough competition in the second half.

In jadak, we expect growth to resume in the second half of the year.

But just as you consolidate 2 in the second half of the year, will the vision see any core growth?

I mean, is the second half better than 0?

Robert Barkley, we haven\'t talked about the specifics yet.

I think there will definitely be some challenges there.

So from the perspective of organic growth,-

The decline in WOM is more important than the increase in JADAK.

So there will be some challenges there.

But in our view, this is very temporary.

I would say that Matthijs GlastraYes, it is consistent and is temporary.

I mean, I think we \'ve been talking about this more or less since last year.

Therefore, this is the guiding or forecasting factor that we take into account in the process of running the business.

Okay, Richard Eastman.

In Q, there are some references in vision--

Gross margin of poor quality impact. Is that --

What does this mean?

Matthijs glastrapretica mobile, I think.

The visual part you\'re talking about is Robert Barkley?

Or the entire company of Richard eastmannis.

Robert Barkley of the whole company, there are some poor quality costs for Precision Sports, which we just mentioned in the script.

But specifically, in the visual part, only--

I just want to say that the existing manufacturing process within WOM is still going through some mature stages.

The most important impact of Ray nash is the mixing effect of higher mixing in consumables, right?

This is the main impact of WOM.

Robert Barkley our business is growing very fast with a slightly lower gross margin, so just take care of it.

Richard eastmanoko

I can ask that the core growth rate we have there is very good in precision motion.

I\'m curious about Celera Motion, is Celera Motion more powerful than these end markets in medical robotics and industrial robotics, or is it reasonably balanced?

Matthijs GlastraYes, so the surgical robot is definitely strong, but driverless vehicles, satellite communications, in general, what I call the trend of mobile robots everywhere-

These are all a variety of applications for driverless cars, so in the comments I have prepared, this is one.

Not only do we provide something on the upper level

In these applications, the final performance range of the motion function itself, but we also provide pointing and tracking capabilities because of these-

These, call--

These vehicles need to know where they are.

They need to be able to fully digitize their environment and they need some very accurate pointing and tracking devices to point and track signals or lights-

In fact, it also has the ability to exercise precisely.

One of them, called, point and tracking devices, is called gimbals, and we are in a unique position in this area, so we actually see some momentum that design has won.

But this is in a variety of applications on the factory floor, in the air and even under water.

So it has a lot of different applications.

Richard eastmanoko

Then the last question is to talk to photon for a while.

Two things, I mean.

Similarly, as the core grows, is the laser quantum of 11% greater or less than that of Cambridge technology?

In other words, how did these two come in relative to the overall photon growth rate of 11%?

University of Cambridge is doing--

To be fair, the University of Cambridge is doing better, but the laser quantum is not far away.

But Cambridge did do better.

Matthijs GlastraYes, so we are very excited about the performance of Cambridge technology, we think Cambridge technology is very strong and continues to be strong.

Laser Quantum, which we said last year in a very spectacular context, we are developing something stronger and harder, so after the launch dynamics, over time, normalize the growth of the business to the Novanta average, right?

So I think we are very consistent in terms of trajectory.

Now, if you look at it in the medium and long term for years of application, this is a very definite grower for us.

So we are still very excited about it.

Richard Eastman\'s done.

Have some reading-

Through your comments [indiscernible]put out.

But there\'s some reading

Comments on China and Europe\'s heavy industry laser market through IPGP.

I\'m just curious if you have any comments.

I know that Cambridge Tech won\'t necessarily play a role in this heavy industry cutting and welding market.

Still, I\'m curious if you see any problems or minor problems or any needs in the Laser Market, in the industrial laser market you compete.

Matthijs GlastraYes. No, thank you.

Obviously we don\'t comment on others, we can only comment on what we see.

I mean, we are very diverse as a company.

So I even commented in the script that like business, like Cambridge technology, we call it horizontal technology business.

It spans many, many applications.

As a result, at the company level, no individual has applied for more than 10% of sales.

We don\'t have any major customer focus.

The largest customers are between 5% and 7%, and the number of our customers is very limited.